A Combined Insurance Review.

This article is part of a series: Life Insurance Company Reviews. For more articles like this, click here.

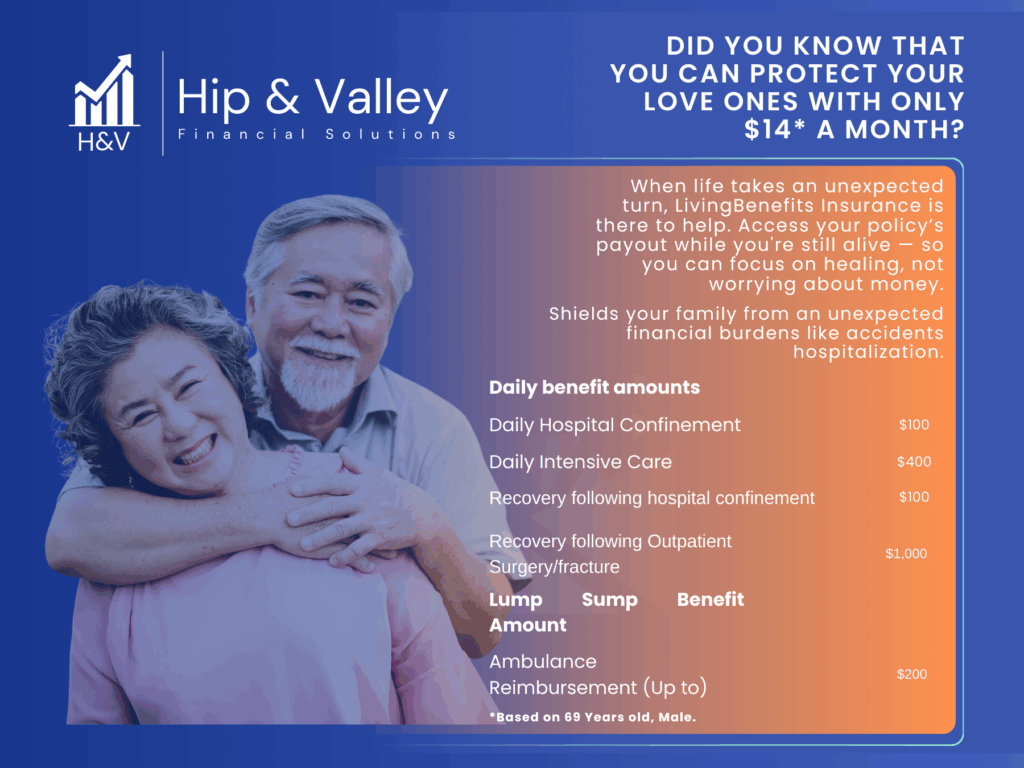

Combined Insurance Review: Why Living Benefits Matter More Than You Think

What if you couldn’t work tomorrow? It’s a question most of us avoid—but the consequences of being unprepared can be devastating. Illness or injury doesn’t just affect your health—it can shake your entire financial foundation. That’s why Living Benefits coverage from Combined Insurance is more important than ever.

Real Life, Real Risk

Imagine waking up unwell, unable to work. The bills don’t stop, and your income suddenly does. Your mortgage payment looms, your child needs money for a school trip, and your emergency fund? Already stretched thin.

Combined Insurance’s Living Benefits are designed to provide a lump-sum payout when you’re diagnosed with a covered illness or suffer an accident—so you can focus on recovery, not your bills.

What Are Living Benefits?

Living Benefits give you access to funds while you’re still alive—a critical distinction. With Combined Insurance, this means a direct, tax-free payout that can be used for:

- Replacing lost income

- Covering rent, mortgage, or utility bills

- Paying for medical treatments or therapies

- Supporting your family during recovery

Whether it’s cancer, a heart attack, stroke, or a debilitating injury, this kind of protection offers vital support.

⭐ Customer Testimonial: Immediate Relief

“When I had to undergo back surgery, I was off work for over three months. Combined Insurance paid me within two weeks of my claim. That money covered my rent, groceries, and even helped with transportation to physiotherapy. I truly don’t know what I would have done without it.”

— Jason M., Calgary, AB

Why Work Benefits Might Not Be Enough

Many Canadians rely on employer-sponsored disability insurance—but these plans often have limits. They might:

- Replace only a portion of your income

- Include long waiting periods

- Be capped, which affects higher earners disproportionately

- End if you leave your job or get laid off

Combined Insurance gives you control. You choose your level of protection and keep it even if you change jobs or become self-employed.

⭐ Customer Testimonial: Coverage that Travels With You

“I lost my job during the pandemic, and I assumed I was out of options. But my Combined Insurance policy was still in place. A few months later, I was hospitalized after an accident and received a lump sum that helped cover my recovery costs while I searched for a new job.”

— Priya R., Mississauga, ON

Emergency Fund vs. Living Benefits

Even the most disciplined savers can’t always prepare for a long-term illness. A 3-to-6 month emergency fund may not cover months—or even years—of lost income. Living Benefits provide financial support exactly when you need it, often within weeks of diagnosis.

Who Benefits Most from Combined Insurance Living Benefits?

✅ Self-employed workers or contractors

✅ Primary income earners

✅ Households with limited savings

✅ Anyone without comprehensive group benefits

⭐ Customer Testimonial: Stress-Free Recovery

“When I was diagnosed with breast cancer last year, I had to stop working. Between my treatments and everyday expenses, I was overwhelmed. The payout from Combined Insurance helped me keep my home, pay for extra care, and focus on healing. It was a blessing during one of the hardest times of my life.”

— Sandra P., Toronto, ON

Final Verdict: A Smart Layer of Protection

Combined Insurance offers Living Benefits that are flexible, easy to understand, and quick to pay out. Their policies are ideal for people who want peace of mind that their income—and their lifestyle—won’t vanish in the face of a health crisis.

Protect Your Income, Protect Your Peace of Mind

Life is unpredictable—but your financial future doesn’t have to be. A sudden illness or injury can threaten your stability, but Combined Insurance’s Living Benefits can help you stay in control during life’s toughest moments.

Whether you’re self-employed, a family breadwinner, or simply someone who wants to avoid financial hardship in a health crisis, Living Benefits offer real, practical support when you need it most.

🛡️ Don’t gamble on hope—prepare with protection.

📅 Book a free consultation today and find out how to make Living Benefits part of your financial safety net.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as insurance advice. Every individual’s financial situation is unique, and it is essential to consult with a qualified professional for personalized guidance. At Hip & Valley Financial Solutions, we are dedicated to helping you navigate your insurance options and find the best solutions tailored to your specific needs. Talk to an advisor today by emailing inquiry@hipandvalley.ca or calling us at (1) 204.320.5201.

• Best living benefits insurance for contractors Calgary disability insurance provider Combined Insurance Canada Combined Insurance reviews from real clients Critical Illness Insurance Disability Insurance Canada Do I need critical illness insurance in Canada? Financial protection from illness Group benefits vs individual coverage How to protect your income after a diagnosis Income Protection Insurance Income protection Manitoba Income protection Winnipeg Insurance for freelancers in Manitoba Insurance for freelancers in Ontario Insurance for freelancers in Winnipeg Insurance for self-employed Insurance that pays when you can’t work Insurance that pays while alive Living Benefits Insurance Living benefits insurance in Manitoba Living benefits insurance in Toronto Living benefits insurance in Winnipeg Lump-sum insurance payout Manitoba disability insurance provider Short-term disability insurance Tax-free insurance benefit What is living benefits insurance? Why you need income protection in Canada

Last modified: April 30, 2025